Last updated on June 23, 2020

Chris Stanton, chief investment officer at Sunrise Capital, this January said a market correction was long overdue. With risk seemingly everywhere, Stanton predicted a drop of 20% in the S&P 500 by the end of the first quarter, or March 31.

“Rest assured, we’re heading for a correction and I would argue it’s going to be terrifying when it comes,” Stanton said in the Season 2 premier.

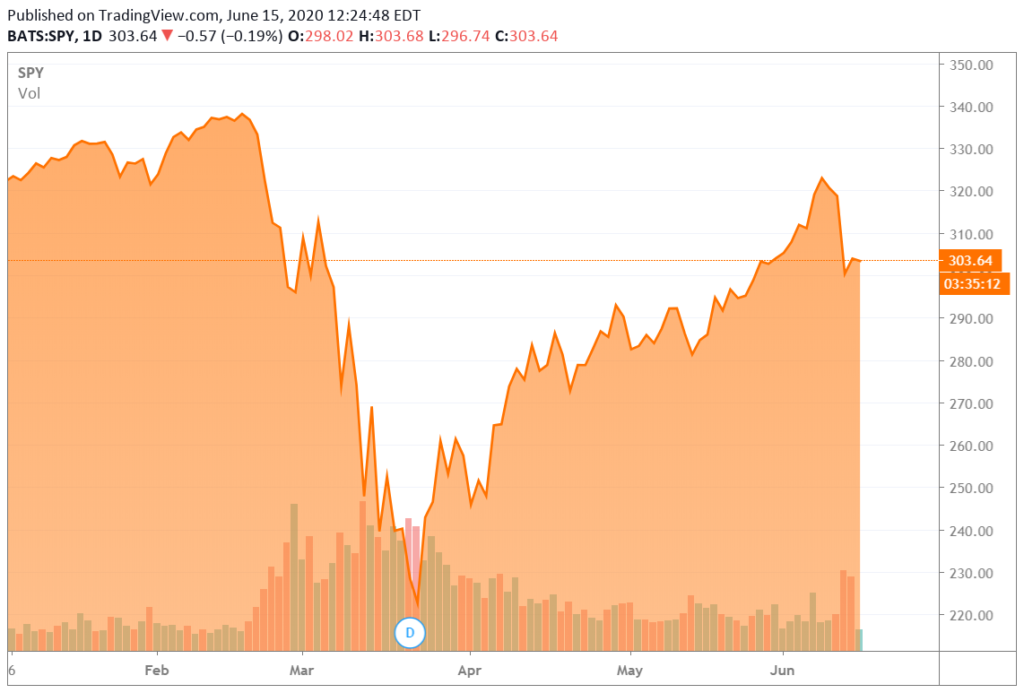

The S&P 500 was around 3,300 at the time of Stanton’s statement.

What Happened

The S&P 500 initially continued its ascent, closing at a record high of 3,386 on Feb. 19. It then started a precipitous decline as the coronavirus caused economies across the world to shut down. Three weeks after the record high, the S&P closed on 2,480, which represented a decline of around 26% in only 16 sessions.

Worse was to come. The index would drop further, to a low of 2,191 on March 23. From peak to trough the S&P 500 dropped by about 35% in 2020, fulfilling Stanton’s prediction.