The following is an amended version of the Nov. 3 Daily Contrarian. This briefing and accompanying podcast are released to premium subscribers each market day morning by 0700. To subscribe, visit our Substack or Supercast.

Stocks cratered yesterday after comments from Federal Reserve Chair Jerome Powell that dashed hopes of a ‘Fed pivot.’ It was at least the second time this year that Powell has popped the ‘hopeium’ bubble; at Jackson Hole in August, his succinct speech caused a similar sell-off.

Weirdly, this month’s Federal Open Market Committee meeting got off to a bullish start. The Fed raised interest rates by 75 basis points as expected, but added new language to the policy statement, that it would take into account “cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

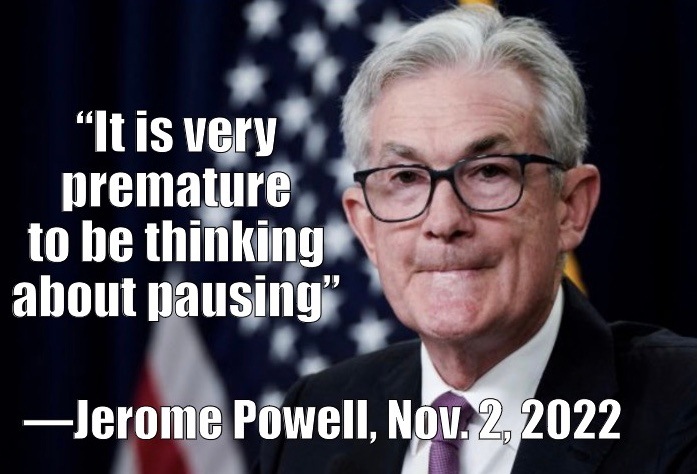

Investors initially took this wordy statement as the long-awaited ‘pivot’ signal and bid up stocks. That lasted for about an hour until about halfway through Powell’s ensuing press conference when he announced it was “very premature to be thinking” about pausing rate hikes.

“People when they hear ‘lags’ think about a pause,” Powell said, an apparent direct reference to the new sentence in the policy statement. “It is very premature, in my view, to think about or be talking about pausing our rate hikes,“ he added. “We have a ways to go.”

Hopeium: A Helluva Drug

Investors have been playing a game of chicken with the Fed for some time, periodically acting like a pivot is imminent despite (let’s face it) little evidence. It seems whenever these hopes get too pronounced and stocks start rallying for real that Jay Powell comes out and dashes all hopes. That was certainly the story at Jackson Hole. The scene repeated itself yesterday.

Will investors learn from this? Will they now take Powell by his word that things need to ‘break’ in the economy before there can be any progress on inflation?

Probably pretty unlikely.

At least we now know exactly how the scene will unfold: Some dovish Fed officials will make public comments about pivoting or ‘stepping down’ and the market will rally. It will be helped along by commentary from ‘Fed watchers’ on the sell side (or in asset management. Cough, Blackrock). The rally will intensify, then Powell will come out and kill it again.

The only way we can realistically hope for a Fed pivot is if inflation starts to ease. That isn’t happening yet. Nobody knows when it will. Most guesses on this have so far proved wide of the mark. A reminder to watch the data, not the commentary.