The following is an amended version of the Oct. 24 Daily Contrarian. This briefing and accompanying podcast are released to premium subscribers each market day morning by 0700. To subscribe, visit our Substack.

Stocks had another big rally on Friday to conclude their best week since June and first three-week winning streak of the year. Major US indexes were all up multiple percent on the day. The apparent catalyst was a Wall Street Journal story that the Fed officials are “signaling greater unease with big rate hikes.”

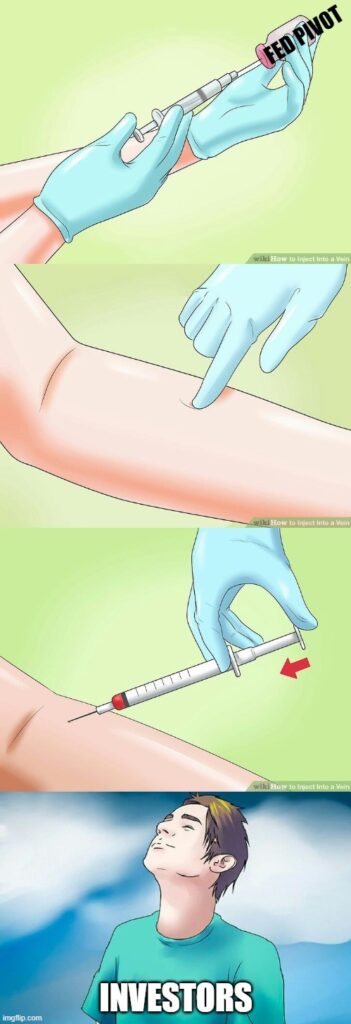

The Fed appears to have coordinated this latest injection of hopeium. San Francisco Fed President Mary Daly had the most succinct comments on Friday, saying “the time is now to start planning for stepping down.” The talk is that there will be another 75bps rate hike at the Fed’s next meeting and then 50bps in December.

Markets have taken all this as a clear sign that the Fed is indeed going to blink and back off of raising rates aggressively for much longer. There may be good reason to suspect the Fed will indeed go this route as there are indications that things are starting to break in the global economy. The UK is the main illustration for this.

The market may very well be correct in this assessment this time, but we’ve seen this movie before. The fact remains that with inflation high it is going to be very difficult for the Fed to justify moving to a neutral interest rate policy. When things do break it will very likely get ugly. It always does. That will bring inflation down for sure — along with create a bunch of other effects we haven’t begun to see in the US yet.

So yeah, Fed officials may be getting scared of the monster they have created (which interestingly was done to fight another, earlier monster of the same Fed’s creation). Doesn’t mean they’ll be able to do anything. Talk is cheap. We’ll see at the Fed meeting next week whether this goes anywhere. In the meantime we’ll get a fresh inflation reading on Friday with the PCE deflator.