Last updated on August 1, 2022

The following is an amended form of the Daily Contrarian briefing from June 17. This briefing and accompanying podcast are released to premium subscribers each market day morning by 0700. To subscribe, visit our Substack.

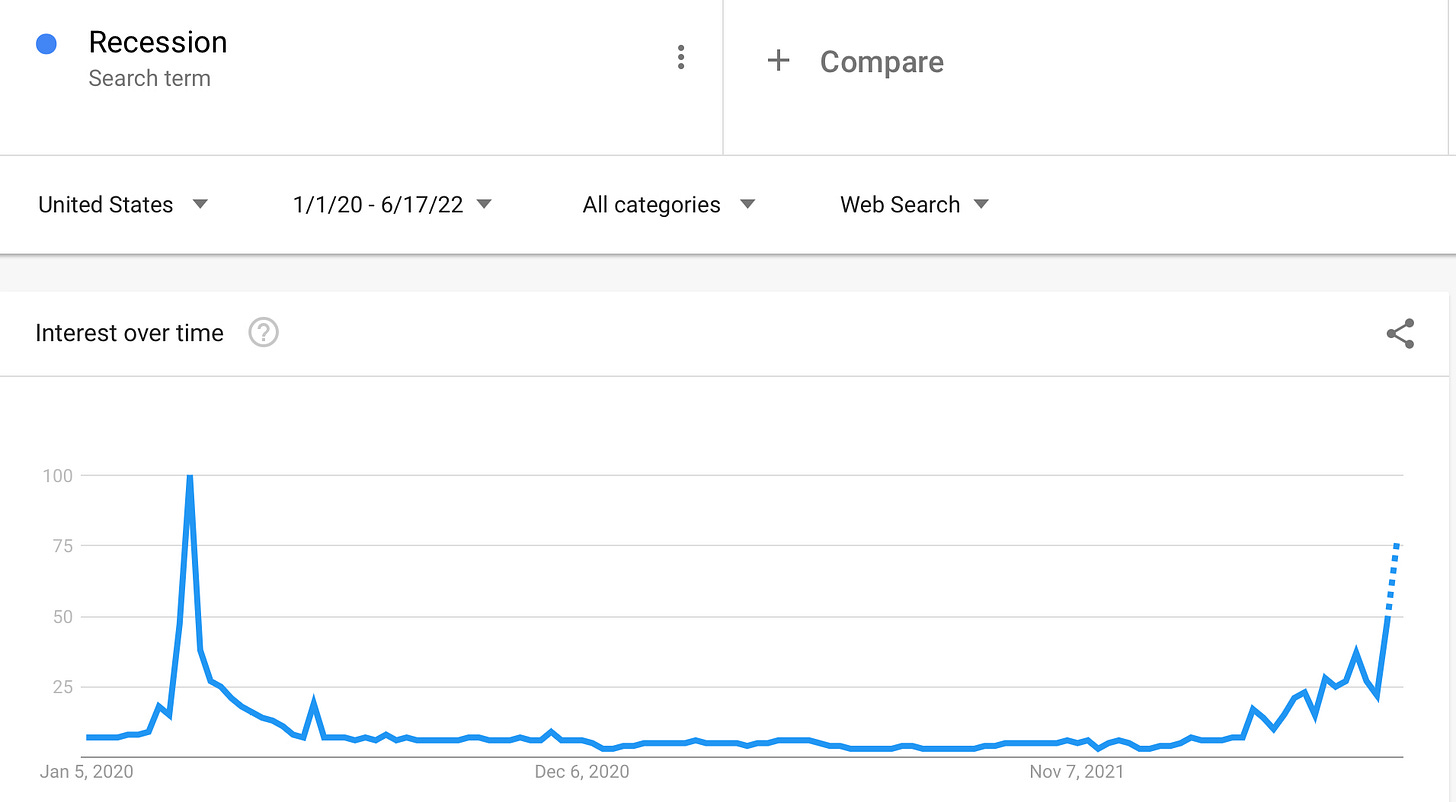

Talk of recession has emerged in force this week after the Fed raised rates by 0.75% and stocks sold off. Google Trends shows keyword searches for ‘recession’ at their highest level since the onset of the pandemic.

There may not be much in the way of hard data that points to economic contraction: employment is still healthy and consumers are (for now) still spending money. But that hasn’t stopped stocks from behaving like the darkest days of a nasty bear market. The bounce in equities we saw during the pre-market this morning is consistent with this, as during bear markets stocks often show signs of life in the pre-market and at the open, only to sell off during the regular session.

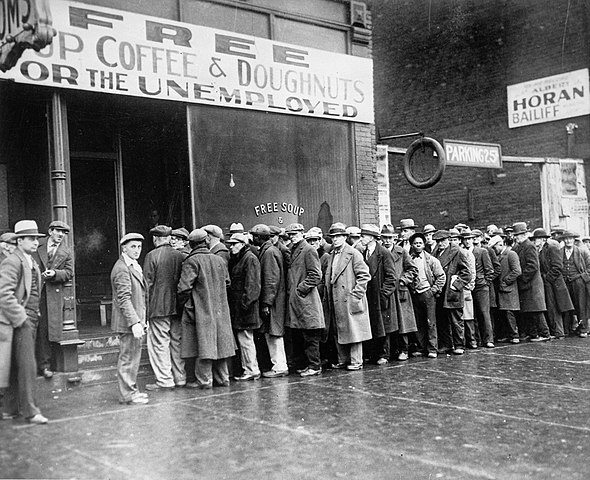

How bad things get is still up for debate. It’s worth remembering that there is no such thing as a “mild recession” when you’re going through it. Those labels are added after the fact. (Source: Your author lived through the “mild recessions” of the early 1990s and early 2000s. They were certainly not mild at the time, in fact there was ample talk about the worst economic slowdown since the Great Depression. This talk resurfaced again in 2008, this time much more justifiably).

That doesn’t necessarily mean we’re going to see bread lines. But we don’t know where and when the dominos will fall. Therein lies the problem. Nothing ever really happens in isolation in global financial markets. The meltdown we’re seeing in cryptos (probably still in the very early innings) is in all likelihood going to be felt elsewhere. Once investors have to liquidate assets to raise cash, it can start a vicious cycle. Selling begets selling and then in asset classes thought to be immune — or at least somewhat protected.

This leads to defaults and bankruptcies, which can then bring down counterparties. That brings systemic risk, a term we haven’t heard about since the dark days of 2008 and 2009. And that’s not even mentioning the societal effects of unemployment, wealth destruction, evictions, etc. etc.

The Bottom Line

We’re obviously getting ahead of ourselves here. Probably this won’t be as bad as 2008. But that doesn’t mean it will be painless. The uncertainty of the whole thing is the problem. Remember markets hate uncertainty more than bad news. Most of this uncertainty comes at the start of these bear markets. That’s where we are now. That’s also where you see some of the most precipitous selling. Sure, we’ll get some bounces here and there. But the main direction will be down, down, down.

This all sounds pretty dramatic, which means it should rightly be viewed as a contrarian indicator. And who knows, maybe it is. But with the Fed removing liquidity from the system, this is normally how things transpire. To repeat the mantra from the start of this week: Don’t Fight The Fed.