Last updated on August 1, 2022

The following is an amended form of the Daily Contrarian briefing from June 22. This briefing and accompanying podcast are released to premium subscribers each market day morning by 0700. To subscribe, visit our Substack.

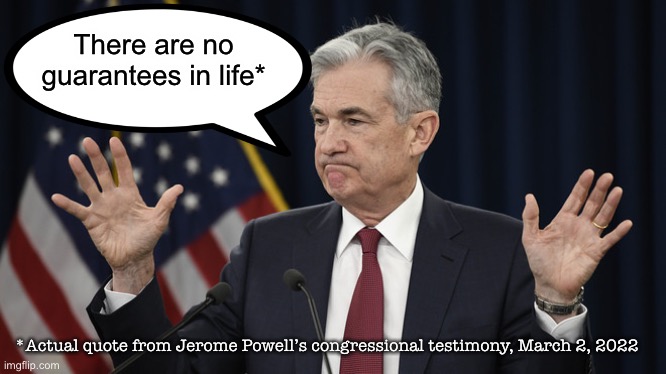

Federal Reserve chair Jerome Powell starts two days of testimony in Washington, D.C. today. Powell addresses the Joint Economic Committee and take questions from the politicos. Don’t expect anything in the way of nuanced or educated questions from these folks. They’ll all be trying to score political points for the cameras.

Still, some details may emerge regardless. Investors will be looking for any indication for when the Fed may stop its interest rate hikes and quantitative tightening. Specifically they’ll be looking for what Powell says the Fed will consider victory over inflationary pressures.

The Bottom Line

A lot of today’s direction will hinge on what Powell says. Ultimately it may not matter. For one, it’s just Powell. For another, it’s just talk. He’s been known to throw markets a bone during times like these but remember what happened the last time he did that? To refresh your memory: he said rate hikes of more than 50 basis points were not being actively considered. Obviously that lack of active consideration didn’t last very long as the Fed raised by 75bps at their last meeting.

Yesterday’s rally is now looking to fade as quickly as it surfaced. There doesn’t appear to have been a catalyst for a move in either direction. These swings happen sometime, especially during bear markets. We are still in a bear market, lest there be any confusion about that. It would be pretty odd if we had already seen the bottom. We still don’t know where the bodies are buried when it comes to cryptos, for example. Those assets are clinging to life right now but with no fundamentals to prop them up, it stands to reason we should see the bottom drop out before too long. That will bring all kinds of collateral damage.

At least, that’s the typical playbook for asset bubble implosions. Maybe this isn’t a typical asset bubble or not a typical implosion? Or maybe it is and this time will be different? Think we all know how that works out…