The following is an amended form of the Daily Contrarian briefing from June 30. This briefing and accompanying podcast are released to premium subscribers each market day morning by 0700. To subscribe, visit our Substack.

It’s been a tough six months — worth first half of the year since 1970 — but at least now you know what a bear market looks like.

If this period has showed us anything, it’s how quickly and violently the consensus can shift — and with no real warning, either. At the start of the year very few were predicting a bear market. Now, the bears certainly look vindicated. On the bright side, as annoying as permabears are they are nowhere near as bad as the crypto cult. At least it’s somewhat entertaining watching the bitcoin bros spin their denial.

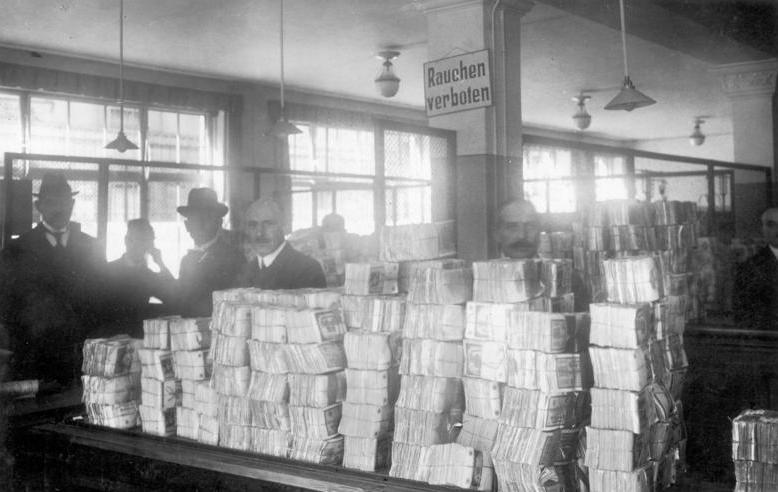

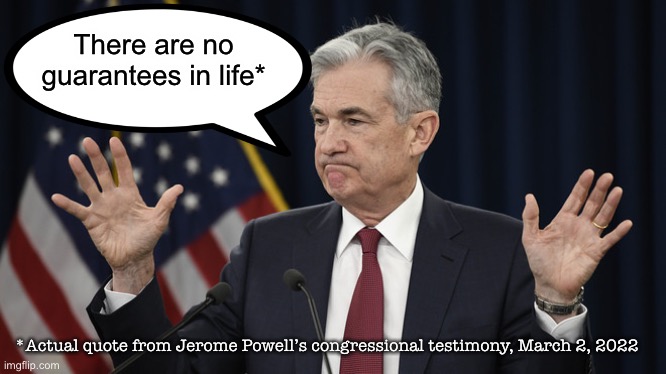

As for the economy, nobody knows how much more pain is ahead, or indeed if the damage is even contained. What’s clear is we have persistently high inflation for the first time in more than a generation. This has given the Federal Reserve no choice but to stomp on the gas pedal where interest rates are concerned — even if it triggers a recession. Fed Chair Jerome Powell even said as much in public comments yesterday.