Last updated on February 3, 2022

Theron de Ris of Eschler Asset Management was bullish on energy, precious metals and royalty and streaming companies in the mining market in November 2020.

Precious metals were in an up-trend but 2020 was the “first year we’ll be seeing some institutional interest develop,” de Ris said at the time.

Additionally, “gold is kind of a bet against bad government decisions and falling trust in the system.” Royalty and streaming companies were poised to come along for the ride as these were “basically financing companies” to “bring mines into production” with the benefit of a cut off the top line, usually into perpetuity.

Among these, de Ris’ favorite was EMX Royalties (EMX).

What Happened

Gold was down 4% for calendar year 2021. In a follow-up interview, de Ris said he didn’t see the institutional interest develop that he had hoped for.

“There was starting to be some interest in the first half of the year, but it kind of drained away, people lost interest,” he said. “I think that’s all still ahead of us.”

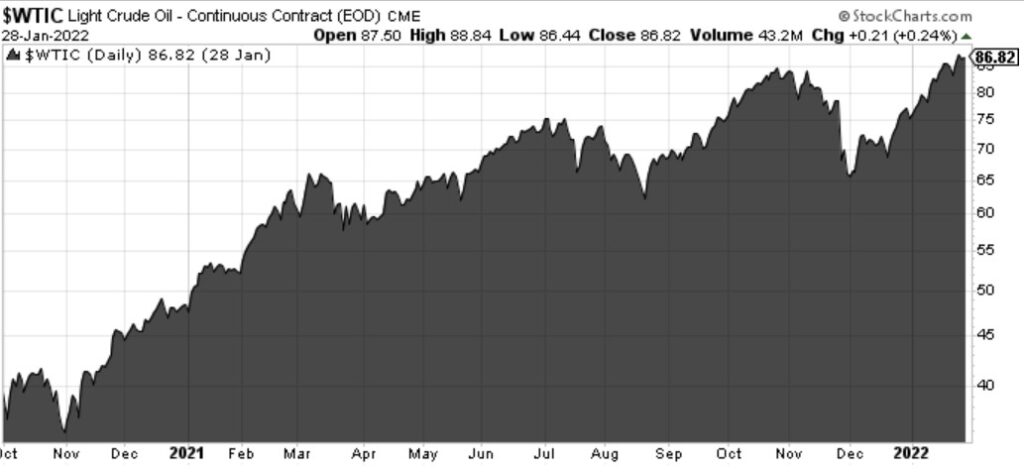

While gold and silver are lower than they were at the time of the podcast, WTI crude has more than doubled.

“You’ve also had cost pressures in the mining industry,” de Ris said. “Because one of the biggest or the biggest input costs is energy. Diesel and the price of oil as well, more than doubled.”

After rallying in late 2020 and the first half of 2021, EMX has sold off, but de Ris still holds the position and remains bullish on the company’s prospects.