Last updated on March 16, 2023

The following is an aggregation of thoughts on the burgeoning banking crisis, as posted in the Daily Contrarian. Subscribe to receive the briefing and accompanying podcast each market day morning.

Last weekend saw the dramatic rescue of Silicon Valley National Bank (SIVB) and Signature Bank of New York (SBNY). The market reaction was drastic, with investors punishing regional bank stocks and today shifting their focus to European banks. Credit Suisse (CS) dropped to an all-time low after its largest investor ruled out further capital infusions.

Unfortunately, the underlying issue facing banks in the US at least remains unresolved. Banks still hold large amounts of held-to-maturity, or HTM, assets. These are US Treasuries and other government bonds that don’t need to be marked-to-market if they are (you guessed it) held to maturity. The problem is if these assets need to be sold, in which case they do need to be marked-to-market. If that happens it leaves banks with a huge hole in their balance sheets from the ensuing write down. See Silicon Valley Bank, which tried to plug their hole with a capital raise. Didn’t work. This issue of HTMs has been known for some time. Here’s a Wall Street Journal piece from November.

By closing Signature Bank, regulators presumably removed the domino that they believed would be the next to fall. The Fed for its part set up an emergency lending program called the Bank Term Funding Program, or BTFP, to shore up liquidity in the financing system. The question now is how effective these measures will be. There is reason to believe they should be at least somewhat effective, according to our guest on this week’s podcast.

That’s great, but then what about the business viability of these regional banks? If depositors are worried about their money it stands to reason that they will move it to a larger financial institution. How can smaller regional banks compete with these juggernauts, especially if they are faced with larger regulatory burdens as can be expected? At best, their margins will be severely pressured. At worst they will have to deal with a run on their deposits.

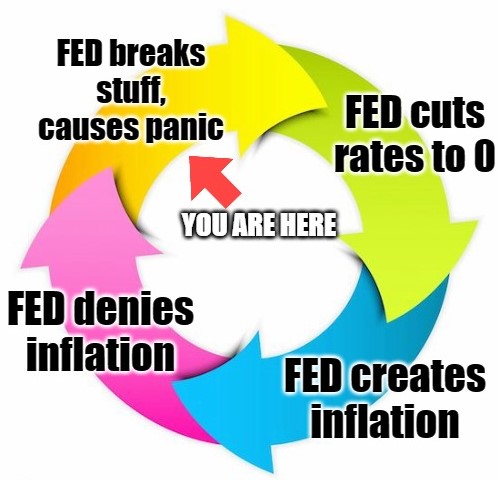

The Fed’s Dilemma

Suddenly the inflation concerns we’ve been discussing are secondary. A bank run like this is by its very nature deflationary. Perhaps as a result, traders are now pricing in a 60% chance that the FOMC will stand pat at its meeting next week, according to Fed Fund Futures. This makes sense also in light of how the Fed’s mission to ‘break things’ has kind of been fulfilled already.

The problem is there is no hard data to support the argument that inflation is coming down as a result of this breakage, seeing how these events literally just transpired days ago. The Fed can certainly argue that from a tangible point of view inflation is no longer a threat. But the official Consumer Price Index is still 6%. The Fed has talked tough on price stability and inflation, and for good reason, but if they cut rates now they face a massive threat to whatever credibility they can still command from the market and from society at large.

This now makes twice in 15 years that reckless Fed policy have caused panics in the financial system. That’s only slightly better than the pre-Fed system, which experienced eight bank runs in a period of 50 years prior to 1913. Ending the Fed is a non-starter for a host of reasons, but this does raise the question of whether the Fed’s mandate needs adjustment (one idea: allow the Fed free reign in adjusting interest rates in a band. Call it 2% to 5%. For anything outside that band they need congressional approval).

Memories of Financial Crises Past

Finally, let’s not forget that episodes like this rarely happen in isolation. Fifteen years ago almost to the day, Bear Stearns went under. A period of relative calm ensued for a few months. Markets even rallied, with the SPY gaining 15%. Then in August Fannie and Freddie were taken over by the government. The following month, Lehman Brothers happened. Very rarely (actually never) do financial markets implode all at once. Even the 1929 crash was followed by a dead cat bounce (it’s true, look into it). If this is another one of those implosions, then it is proceeding on schedule.

Of course, that doesn’t mean it is definitely one of these implosions. We very well may be in the clear. Again, markets are certainly behaving that way. Markets aren’t always right, but sometimes they are. Is this one of those times? You tell me. Whatever your views, be sure to do your own research and make your own decisions.