Bob Elliott, chief investment officer of Unlimited Funds, joins the podcast to discuss his views on the Federal Reserve, inflation, the midterm elections, and why stocks have entered a long ‘slog’ for the foreseeable future.

Content Highlights

- Investors have been conditioned for recessions to feature a fast decline in equity markets followed by a rapid recovery. This time around those dynamics are different (3:44);

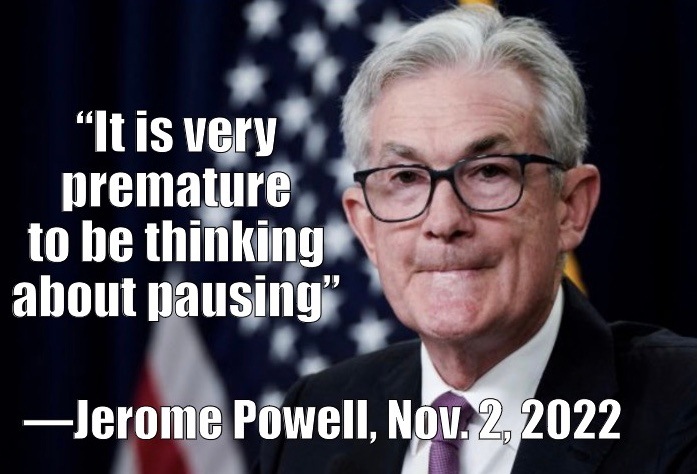

- There is no chance of a ‘Fed pivot’ coming anytime soon (7:58);

- What about infighting at the Fed and within the FOMC? (11:03);

- Yes, you need unemployment to increase for there to be any progress with inflation. Higher prices are no longer due to supply chain issues (13:57);

- The Fed will raise either 50bps or 75bps at its next meeting and rates could easily go up to 6% (21:22);

- Background on the guest and his ETF, the Unlimited HFND Multi Strategy Return Tracker ETF. Stock ticker: HFND (26:19);

- The growing disconnect between hedge fund positioning and retail investors: Hedge funds are short bonds, long commodities, bullish gold, and are sitting on a bunch of cash… (36:21);

- The Fed’s target rate for inflation is 2%, but that could change. That would bring a myriad of issues… (38:24);

- It’s hard to get bullish about longterm bonds: right now and for the foreseeable future (40:54);

- Investors continue to look for reasons that the economy is slowing and the Fed needs to reverse course. There is virtually no evidence of this happening (42:44);

- The midterm elections are likely to lead to a split government. This brings tail risks that few people are talking about (44:50).

More Information About Bob Elliott

- Website: UnlimitedFunds.com;

- Twitter: @BobEUnlimited;