This episode is brought to you by StockMarketHats.com — claiming to be stylish and funny. To avoid ads, consider becoming a premium subscriber.

Deer Point Macro joins the podcast to discuss his view that the U.S. Federal Reserve will only hike interest rates once more before easing.

Content Highlights

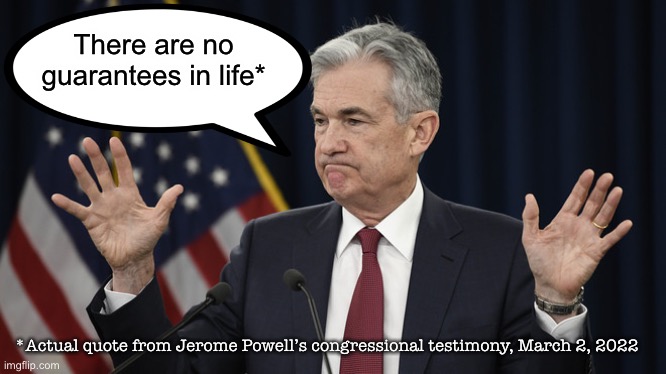

- The Fed is not some magical organization that can control all parts of monetary economics (2:50);

- The Fed can create demand for credit, but banks have to provide supply. And banks are pushing back (5:03);

- What to make of the Fed’s rate hikes this year? How has that affected bank portfolios? (9:37);

- The eurodollar market plays a significant role in Fed policy and its implications. An explanation (13:24);

- The Fed stands to raise once more, at its next meeting in July, before having to cut rates in September (16:21);

- Inflation is stubbornly persistent. Doesn’t this force the Fed to raise rates? (19:57);

- Background on the guest (30:14);

- Markets don’t really react to ADP employment data, but for economic detective work it can be vitally important (31:48);

- How this all translates to asset prices: good for bonds but commercial banks are maybe not as safe as some would think. But regional banks may be a better bet (35:11);

- What about cryptocurrencies? (36:34);

- Quick discourse on the so-called ‘Fisher effect’ that posits that inflation rises as Fed funds increase — over the long term (39:14).