What Was Said

Michael Kahan of hedge fund North Peak Capital Management was bullish on time share companies, identifying Hilton Grand Vacations (HGV) as one of his fund’s key positions.

“Look, the stock’s been beaten up considerably,” Kahan said at the time. “When you have a stock that’s trading at 6 or 7 Ebitda multiple and a sub-10 P/E, you know it’s not beloved by the world.” This was a buying opportunity, and the company also had several defensive characteristics that were overlooked by the market.

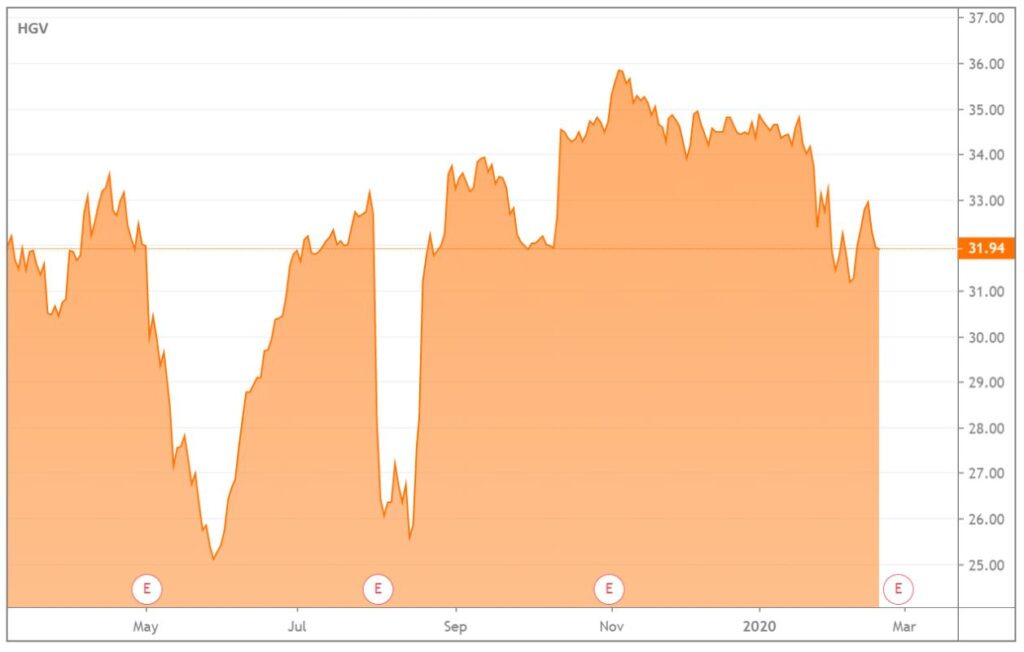

Shares of HGV were trading around $29 when Kaman provided his comments.

What Happened

HGV traded mostly sideways for the next two months. Then, on Aug. 19 the New York Post reported that Leon Black’s Apollo Global Management was in talks to buy the company “for as much as $36 per share.”

Predictably, the stock popped on the news:

Other news reports soon followed, adding to the Post’s story. HGV was exploring a sale, Reuters reported Aug. 29. The company was attracting bids of $40 per share, Bloomberg reported in October. HGV reached a 52-week high of $36.56 per share in November.

By that point, North Peak had sold its stake. “We’re no longer involved in Hilton Grand Vacations,” managing partner Jeremy Kahan (Michael’s brother) said in an interview on Feb. 20. The firm exited around $36 per share after it became clear the company would be sold, he said.

Leave a Comment