Hugh Hendry is a man who needs no introduction to contrarians. Over the course of this 90-minute conversation, he provided many views on markets, the economy, the Federal Reserve, China, and a lot more. Of particular interest to investors are his bullish views on commodities, oil producers, and luxury goods makers…

Content Highlights

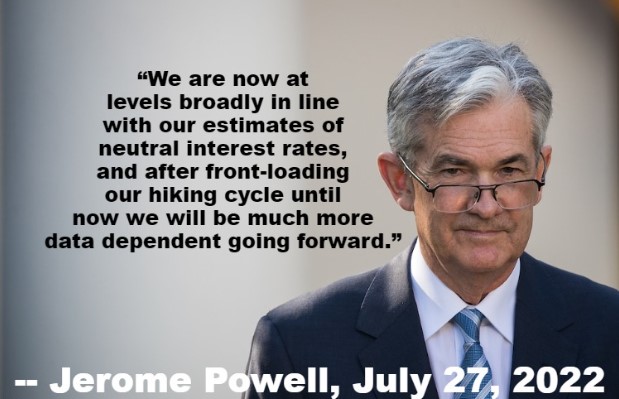

- Hendry’s most contrarian opinion right off the bat: The Fed is not responsible for the asset price bubble (2:40);

- “We find ourselves in the fourth depression of the last 200 years” after “les miserables” period of 1830 to ~1855, 1870 to the late 1890s, and the 1930s (8:11);

- “I don’t think we have inflation.” Sales of non-discretionary items are not increasing (13:53);

- Very few people understand money and money creation. What are they missing? (28:56);

- What’s behind the stock market rally this summer? It may be commodities, at least in part… (39:49);

- Markets are ‘bucking broncos.’ Volatility can be a major distraction and nothing happens in a straight line. But commodity producers and uranium should be in good shape over the long term (46:55);

- Background on the guest. As an ‘OG contrarian’ Hendry joins an exclusive list (54:58);

- A little insight into Hendry’s current life and psychology (1:10:40);

- Betting on the Chinese yuan weakening (1:14:37);

- The odds of the 10-year treasury making new lows (1:22:44);

- China invading Taiwan? Hendry sets the odds at 20% and says China will never have a stronger bargaining positioning vis-a-vis the U.S (1:24:16).

More Information on the Guest

- Twitter: @Hendry_Hugh;

- Substack: HughHendry;

- Instagram: HughHendryOfficial;

- YouTube: HughHendryOfficial;

- The Acid Capitalist.