The following is an amended form of the Aug. 22 Daily Contrarian. This briefing and accompanying podcast are released to premium subscribers each market day morning by 0700. To subscribe, visit our Substack.

Stock futures are selling off in Monday’s pre-market, continuing the trend that started early Friday with the crypto flash crash.

Meme stocks are seeing the worst of it, with AMC Entertainment (AMC) dropping more than 30% ahead of the new APE listing. Shares of GameStop (GME) and Bed, Bath & Beyond (BBBY) are down multiple percent as well.

There is once again no clear catalyst for the move downward. There have not been any new developments with the Fed, nor new earnings or economic data that could have caused this.

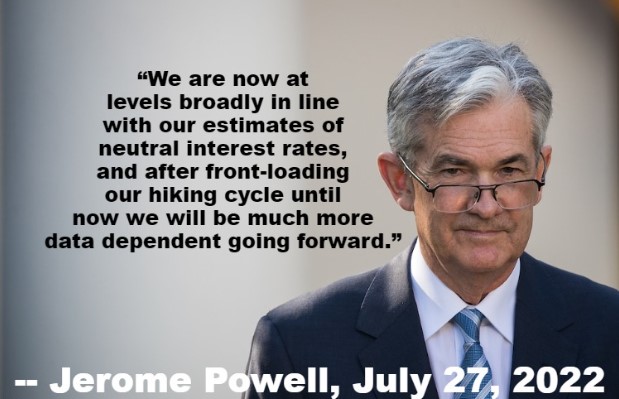

There may be concerns ahead of the Jackson Hole Symposium, which starts Thursday. Before that we’ll get some earnings, though frankly last week’s retailer earnings were probably more important. Friday is Powell’s speech at Jackson Hole and the PCE Deflator to provide some more intel on inflation.

Or maybe the bear market is back? There doesn’t always have to be a clear catalyst for investors to dump risk assets. Maybe the bear never left. Bear markets do have rallies, sometimes quite significant ones.

Leave a Comment