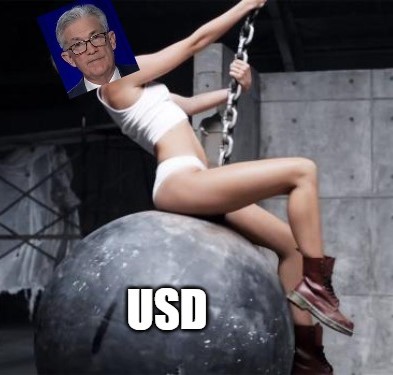

A short synopsis of the Fed’s determination to ‘break things’

The following is an amended version of the Oct. 7 Daily Contrarian. This briefing and accompanying podcast are released to premium subscribers each market day morning by 0700. To subscribe, visit our Substack.

Non-farm payrolls this morning came in at 263,000, ahead of economist forecasts of 250,000. The unemployment rate dropped to 3.5% (it was expected to hold at 3.7%). The headline number was a decrease from the 315,000 figure seen last month and constitutes the lowest reading of the year. That was little consolation for investors who took the opportunity to sell stocks again.

Here the formula was the same it’s been: investors were rooting for a soft number signifying a slowing labor market, simply because it would bring more hope of a quicker Fed pivot away from interest rate hikes.

‘Breaking Things’

The NFP report demonstrates that in the US economy at least, nothing really appears broken. Consumers have been able to afford the higher prices for goods and services — mainly because they’re still employed and even still getting raises. That’s a problem because Fed officials are on record stating they are determined to tame inflation even if it means ‘breaking something’ in the economy.

Of course, talk is cheap. Each time investors bid up stocks they have essentially been calculating that if there is a real pain point in the economy, the Fed will probably see it as reason enough to pivot and flood the market with liquidity again.

Perhaps this calculation will even be right. But the ‘pain point,’ wherever it ends up occurring, is likely to cause a blast radius with second- and third-order effects. The damage will likely be widespread, perhaps even in areas none of us can envision right now. Unwinds of this magnitude are very rarely painless.

Remember too that it takes up to a year for Fed rate hikes to work their way through the economy. This tightening cycle started in March. That puts us seven months in. Potentially still months away from when things even start breaking.

That all makes for a guarded market. Sure, there’s a chance investors could throw caution to the wind and bid up assets into year-end. But with all this uncertainty still out there, it’s difficult to make the case for taking risks. Markets hate uncertainty more than they hate bad news.

For what it’s worth, none of this is investment advice. Do your own research, make your own decisions.

Leave a Comment